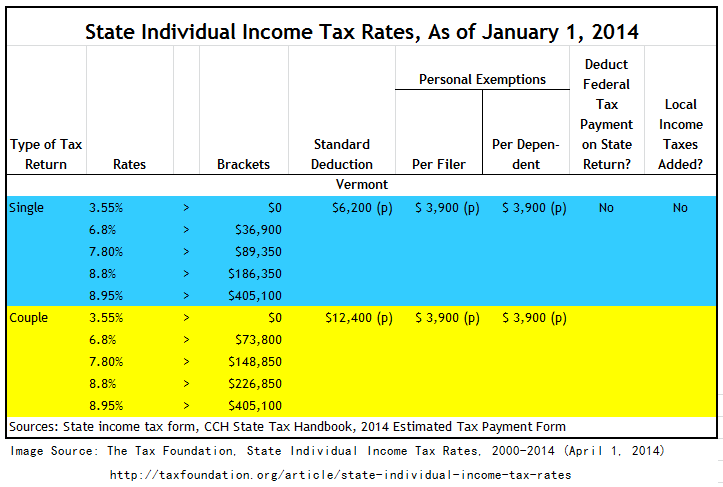

vermont income tax brackets

PA-1 Special Power of Attorney. Vermont School District Codes.

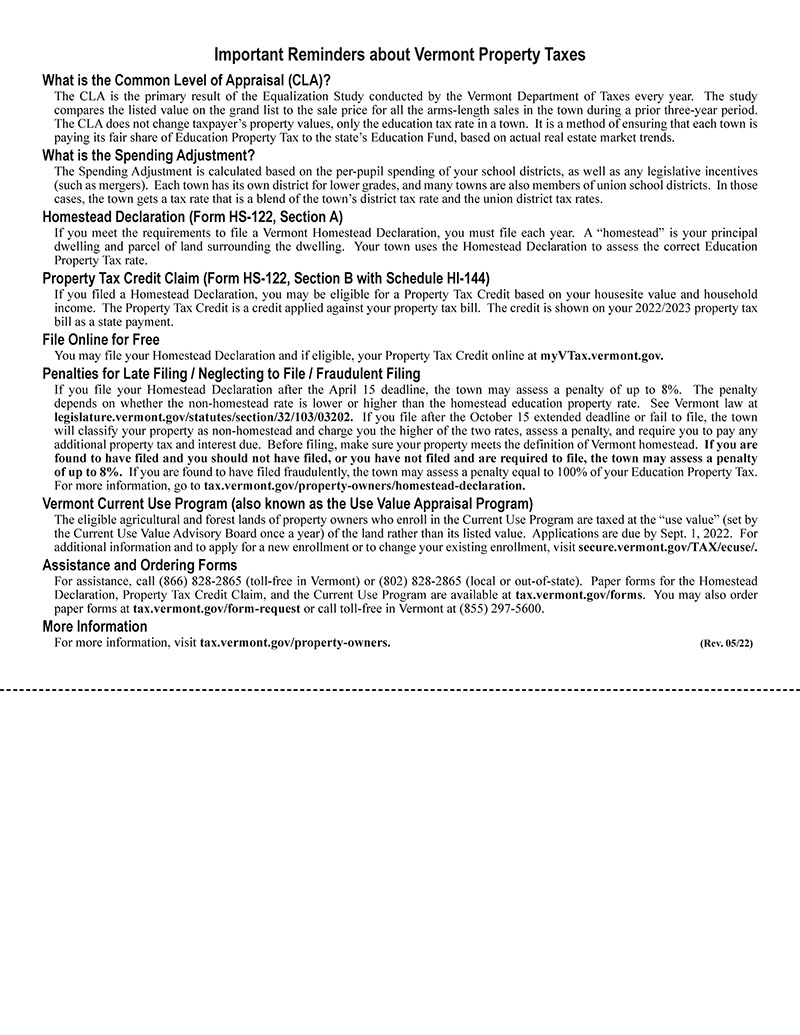

Vermont Property Tax Rates Nancy Jenkins Real Estate

BA-403 Application for Extension of Time to File Vermont CorporateBusiness Income Tax Return CO-414 Estimated Payment Voucher.

. Vermont Income Taxes. 2017 VT Rate Schedules. Those that are filing as single see tax rates that range from 335 to 875.

What is the Single Income. 2017 VT Tax Tables. The Vermont Single filing status tax brackets are shown in the table below.

IN-111 Vermont Income Tax Return. Vermont Single Tax Brackets TY 2021 - 2022. W-4VT Employees Withholding Allowance Certificate.

Income tax tables and other tax. 2019 Income Tax Withholding Instructions Tables and Charts. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

This form is for income earned in tax year 2021 with tax. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator. Vermont School District Codes.

Taxable Income USD Tax Rate. IN-111 Vermont Income Tax Return. Vermont Tax Brackets for Tax Year 2020.

These taxes are collected to provide essential state functions resources and programs to. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes.

More about the Vermont Tax Tables. W-4VT Employees Withholding Allowance Certificate. PA-1 Special Power of Attorney.

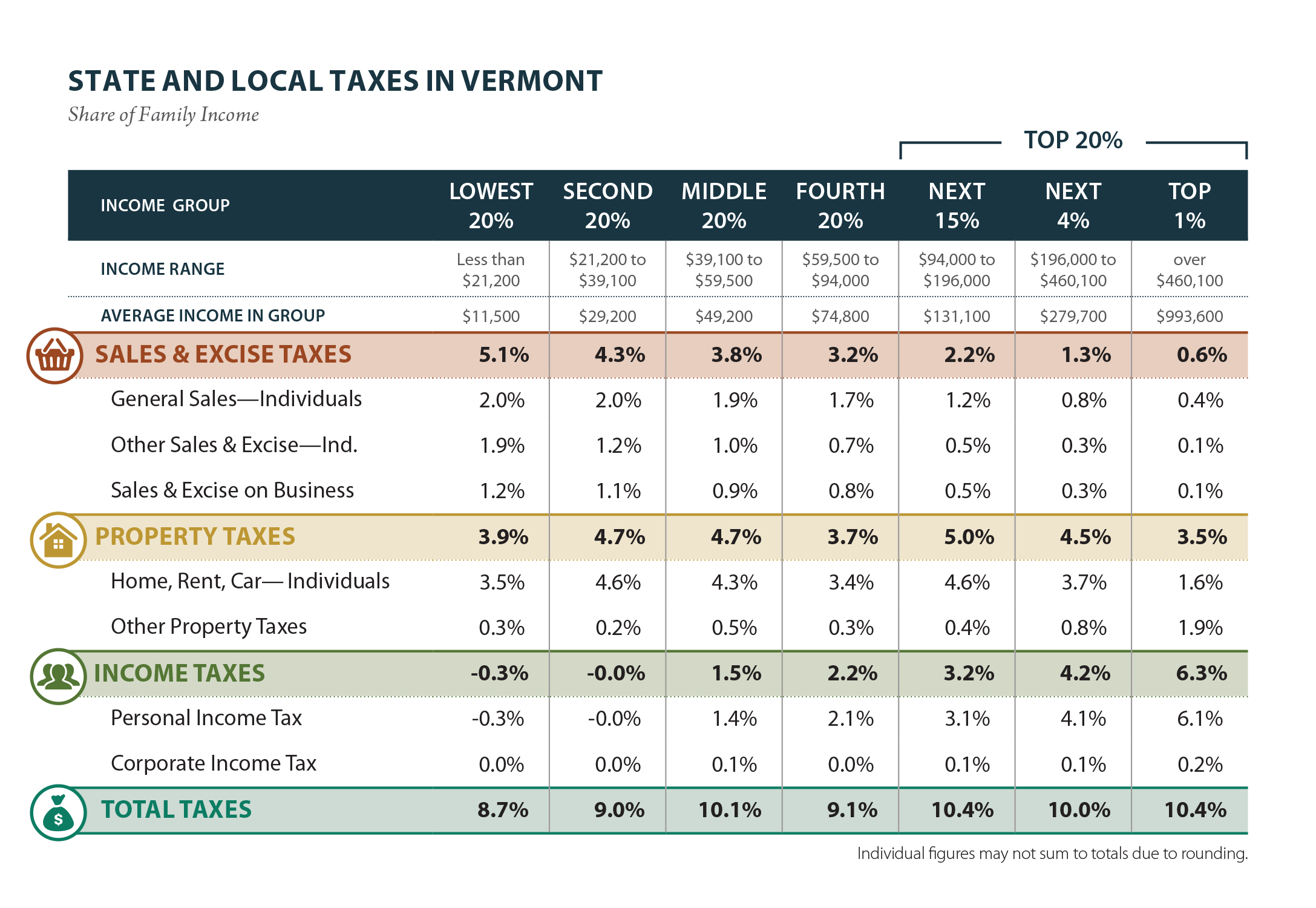

The major types of local taxes collected in Vermont include income property and sales taxes. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. The tax brackets are different depending on your filing status.

Vermont Corporate Income Tax Brackets Tax Bracket gross taxable income Tax Rate 0 6000. 2017-2018 Income Tax Withholding Instructions Tables and Charts. Detailed Vermont state income tax rates and brackets are available on this page.

Pay Estimated Income Tax Online. For 2022 tax year. More about the Vermont Tax Rate Schedules.

Any income over 204000 and 248350 for. 2016 VT Rate Schedules and Tax Tables. As you can see your Vermont income is taxed at different rates within the given tax brackets.

Rates range from 335. Vermont also has a 600 percent to 85 percent corporate income tax rate. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

CO-414 Estimated Tax Payment Voucher. Pay Estimated Income Tax by Voucher. Vermont Income Tax Rate 2020 - 2021.

This form is for income earned in tax year. Detailed Vermont state income tax rates and brackets are available on this page. 2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Tax Bracket Tax Rate. Vermont Income Tax Brackets. Vermont Income Tax Return.

Vermonts 2022 income tax ranges from 335 to 875. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. In addition to the Vermont corporate income. Compare your take home after tax and estimate.

PA-1 Special Power of Attorney.

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

State Income Tax Rates What They Are How They Work Nerdwallet

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

States With The Highest Lowest Tax Rates

Vermont State Tax Guide Kiplinger

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

How Do State And Local Property Taxes Work Tax Policy Center

State Withholding Tax Table Maintenance Vermont W Hx03

Understanding Your Property Tax Bill Department Of Taxes

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

Vermont Income Tax Calculator Smartasset

New Report Vermont S Tax System Is Among The Least Regressive Public Assets Institute

Vermont Who Pays 6th Edition Itep

4 27 15 The Carolina Cage Match Peter Shumlin Versus Rational Public Policy

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Co 411 Fill Out And Sign Printable Pdf Template Signnow

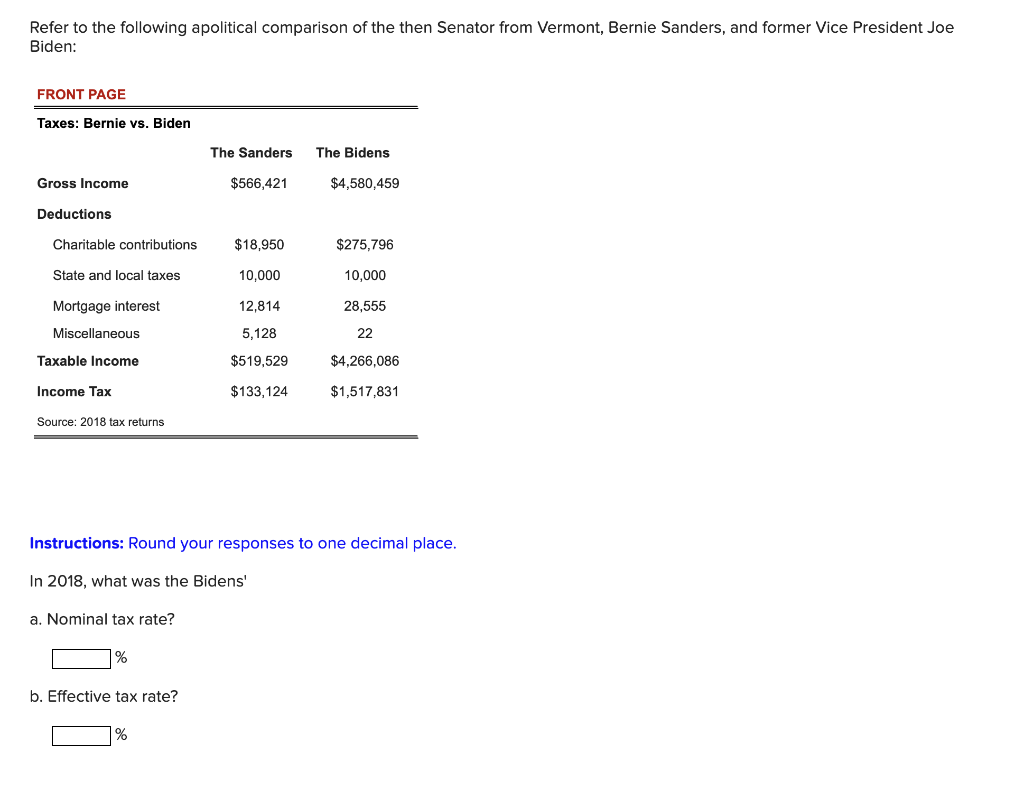

Solved Refer To The Following Apolitical Comparison Of The Chegg Com

How To Update State Taxes In Total Planning Suite Desktop Edition Moneytree Software

Filing A Vermont Income Tax Return Things To Know Credit Karma